Most B2B marketing teams invest resources in blog posts, whitepapers, and case studies without fully understanding what their audience needs. And, Content that gets ignored, campaigns that miss the mark, and marketing budgets that feel wasted.

Here’s what I’ve learned after years in B2B content marketing: successful content doesn’t start with writing, it starts with research. A solid B2B content research methodology transforms guesswork into strategy, helping you create content that truly resonates with your target audience and drives measurable business results.

In this guide, I’m breaking down everything you need to know about B2B content research. Whether you’re working with a B2B content marketing agency or building your content strategy in-house, these research methods will help you understand your audience, identify real opportunities, and create content that actually converts.

B2B Content Research Methodology

B2B content research methodology is the systematic process of gathering, analysing, and applying data to inform your content marketing decisions. It’s about understanding what your target audience needs, what questions they’re asking, and how they make purchasing decisions.

Think of it as the foundation of your entire content strategy. Without proper research, you’re essentially creating content in the dark, hoping something sticks. With research, you know exactly what to create, when to publish it, and where to distribute it for maximum impact.

Research helps you answer critical questions like:

- What topics does your audience care about most?

- What pain points keep them up at night?

- Which content formats do they prefer?

- Where do they consume content?

The difference between companies with strong B2B content marketing strategies and those struggling to get traction often comes down to research. Companies that invest in understanding their audience create content that educates, engages, and converts.

Why is B2B content research important?

Today’s B2B buyers consume an average of 13 pieces of content before making a purchase decision. They’re researching independently, comparing solutions, and forming opinions about brands long before ever contacting sales.

Recent data shows that B2B content consumption surged by 34% from 2020 to 2021, and that trend continues. Remote work has made digital content the primary source of information for business professionals. Your prospects aren’t attending as many in-person events or meeting sales reps face-to-face. They’re reading blogs, watching videos, and downloading resources online.

You need to understand:

Where your audience spends time online

Social media has become a major channel for B2B marketing, but not all platforms work the same way. LinkedIn might be perfect for one audience, while Twitter or industry-specific forums might work better for another.

What format resonates with them

Some people in your audience will happily read a 20-page whitepaper. Others just want a quick video or a simple infographic they can skim in two minutes. Research shows you which format your specific audience prefers.

What language do they actually use?

Your internal product teams might use technical jargon, but your customers might describe the same solution completely differently. Research helps you match their language.

When they’re ready to buy

Understanding the buyer journey lets you create content for each stage, from initial awareness through final decision-making.

According to industry research, companies using content marketing experience growth rates that far exceed those that don’t invest in content. But that growth only comes when content is based on real insights about what your audience needs.

The Core Components of B2B Content Research Methodology

A comprehensive B2B content research methodology includes several interconnected components. Each serves a specific purpose, and together they give you a complete picture of what content to create.

1. Audience Research

Yes, knowing your target buyer is a “VP of Marketing at a mid-sized SaaS company” helps, but that’s just the starting point.

Effective audience research explores psychographics, behavioral patterns, and decision-making processes. You need to understand their daily challenges, professional goals, how they consume information, and the internal dynamics they navigate when evaluating solutions.

Interview at least 10-15 customers who represent your ideal buyer profile. Make these genuine learning conversations, not disguised sales calls.

Ask questions like:

- What did you search for during your initial research?

- Which resources helped you most during the evaluation?

- What almost made you choose a different vendor?

- What questions did your team ask that were difficult to answer?

These conversations reveal the actual language prospects use, the objections they face internally, and the information gaps your content needs to fill.

Sales teams hear the same questions repeatedly; those questions are content opportunities. When a prospect asks your sales rep to explain something, that’s a clear signal you need content addressing that topic.

Pay attention to:

- Questions people ask in LinkedIn groups or industry forums

- Complaints or frustrations mentioned in reviews

- Topics that generate high engagement on social media

- Terminology and phrases your audience uses naturally

Based on your research, develop 2-4 buyer personas representing your key audience segments. Include their role, goals, challenges, information sources, and content preferences.

For example, instead of “marketing manager,” create “Maria, Marketing Manager at a 50-person SaaS startup, struggling to prove marketing ROI with limited budget and tools, prefers tactical how-to content and case studies with specific metrics.”

2. Competitor and Market Research

Understanding what’s already working in your space helps you identify opportunities and gaps. This isn’t about copying competitors, it’s about learning from the market and finding your unique angle.

Look at the top-performing content from your main competitors. Tools like Ahrefs or SEMrush help you identify which pages get the most traffic, which content attracts backlinks, and which topics generate engagement.

Look for:

- Topics they cover extensively

- Gaps in their coverage

- Content formats they use successfully

- How they position their solutions

- Their content publishing frequency and consistency

Even if they’re not direct competitors, companies like HubSpot, Mailchimp, and Salesforce set the standard for B2B content marketing. Analyze how they structure their content hubs, educate their audiences, and guide prospects through the buyer journey.

For instance, Salesforce’s Trailhead platform gamifies learning, creating a community of over 5 million “Trailblazers.” HubSpot built an extensive educational ecosystem that positions them as the definitive resource for marketing and sales professionals. These aren’t just B2B content marketing examples; they’re blueprints for building authority and trust.

Use Google Trends, industry reports, and news sources to track emerging topics and shifts in your market. Recent research shows that successful content marketers stay ahead by identifying trends early and creating content that addresses evolving customer needs.

If you have existing content, dig into the analytics. Which pieces generate the most traffic? Which converts visitors into leads? Which content do people share most? This historical data guides future content decisions.

3. Keyword and SEO Research

Keyword research is a critical component of B2B content research methodology. It helps you understand what your audience searches for and how to make your content discoverable.

Recent research highlights that keyword research is particularly important in the early stages of the buyer journey. B2B buyers increasingly explore options through search engines and third-party resources before ever contacting vendors.

Use keyword research tools:

Platforms like Google Keyword Planner, Ahrefs Keywords Explorer, SEMrush, or Answer the Public help you identify:

- Search volume for different topics

- Keyword difficulty and competition

- Related questions and topics

Understand why someone searches for a particular term. Are they looking for information, comparing solutions, or ready to buy? Match your content to search intent.

For example:

- “What is marketing automation?” = informational intent (top of funnel)

- “Marketing automation platforms comparison” = consideration intent (middle of funnel)

- “HubSpot pricing” = transactional intent (bottom of funnel)

Tools like Answer the Public show you actual questions people ask. These questions make excellent content topics because they directly address what your audience wants to know.

Identify long-tail keywords:

While competitive head terms like “content marketing” might be difficult to rank for, longer phrases like “B2B content marketing strategy for SaaS startups” are more specific, less competitive, and often convert better because they match specific user intent.

Track your current rankings:

Use tools to monitor which keywords you already rank for and identify opportunities to improve existing content or create new content targeting gaps.

4. Content Gap Analysis

Content gap analysis identifies topics your audience needs, but you haven’t covered yet. This research method combines keyword research, competitor analysis, and audience insights to find opportunities.

Map your existing content:

Create a spreadsheet listing all your current content, the topics covered, target keywords, buyer journey stage, and performance metrics. This gives you a clear view of what you have.

Identify missing topics:

Compare your content inventory against:

- Keywords your competitors rank for but you don’t

- Questions prospects frequently ask sales

- Topics mentioned in customer interviews

- Content requested by your audience

- Stages of the buyer journey where you lack content

Priorities based on impact:

Not all gaps are equal. Priorities based on:

- Search volume and traffic potential

- Relevance to your ideal customer

- Business impact (does it help close deals?)

- Competition level (can you realistically rank?)

- Resource requirements (how much effort to create?)

Sometimes the gap isn’t a missing topic; it’s a lack of depth. You might have a blog post on a topic that really deserves a comprehensive guide, video series, or interactive tool.

5. Voice of Customer Research

Voice of customer (VOC) research captures direct feedback and insights from your customers and prospects. This qualitative research provides context and nuance that quantitative data can’t capture.

Recent research emphasizes that in-depth interviews are particularly valuable for B2B markets because they capture the complex decision-making dynamics involving multiple stakeholders.

Ask open-ended questions:

- Tell me about a specific challenge you faced that led you to seek our solution.

- Who else was involved in the decision? What were their concerns?

- What would have made your evaluation process easier?

- What content or information was most valuable to you?

Analyze customer support data:

Your support team hears directly from customers about their struggles, questions, and frustrations. Review support tickets, help desk data, and FAQ requests to identify content opportunities.

Common support questions often reveal:

- Onboarding challenges that educational content could address

- Features that customers don’t understand and need explanation

- Use cases that customers want to implement but need guidance on

- Misconceptions that content could clarify

Review online feedback:

According to recent market research, analyzing customer opinions in review forums provides valuable qualitative data about pain points and what customers love about your brand. Check platforms like G2, Capterra, Reddit, and industry-specific forums.

Look for:

- Repeated complaints or feature requests

- Praise for specific aspects of your solution

- Comparisons to competitor products

Survey your audience:

Send targeted surveys to customers and prospects to gather quantitative data about content preferences, challenges, and information needs. Keep surveys short and focused, asking specific questions about content topics they’d find valuable.

Monitor sales calls and demos:

Use tools like Gong to analyze recorded sales conversations. This provides insights into:

- Questions prospects ask repeatedly

- Objections that come up frequently

- Features prospects care about most

- The language and terminology they use

- The decision criteria they mention

As one B2B content marketing example, companies like Gong Labs regularly publish insights from their own data research, demonstrating how analyzing customer conversations can fuel content strategy.

Implementing Your B2B Content Research Methodology: A Step-by-Step Process

Now that you understand the core components, let’s walk through how to implement a B2B content research methodology in your organization.

Step 1: Define Your Research Objectives

Start with clarity about what you want to learn. Are you trying to:

- Understand a new audience segment?

- Identify content gaps in your current strategy?

- Improve conversion rates for existing content?

- Expand into a new market or product line?

If you’re launching a new product, customer interviews and competitive analysis might be most important. If you’re optimizing existing content, performance analysis and keyword research might take priority.

Step 2: Choose Your Research Methods

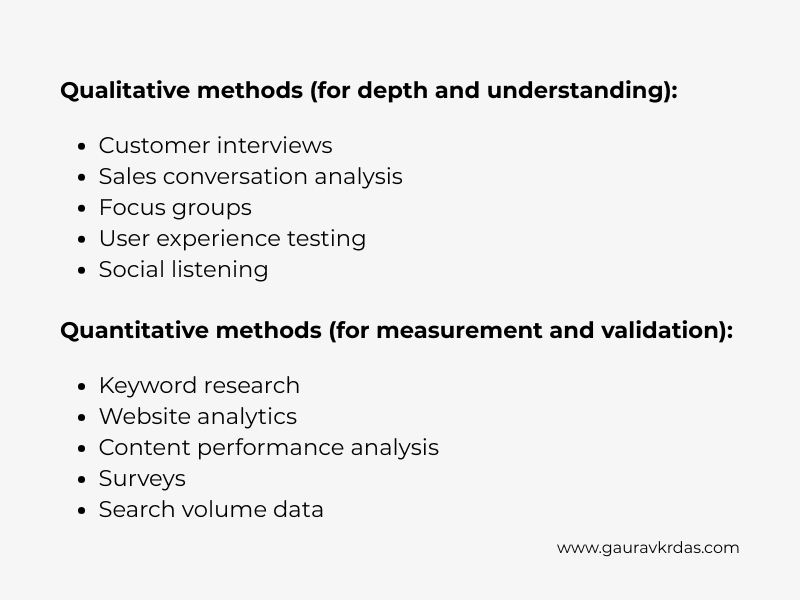

Based on your objectives and resources, select the most appropriate research methods. For most B2B companies, this includes a mix of:

Research shows that combining qualitative and quantitative methods provides the most complete picture. Qualitative research helps you understand the “why” behind behaviors, while quantitative data validates findings across a larger sample.

Step 3: Gather Your Data

Execute your research plan systematically. Some tips:

For customer interviews:

- Start with 10-15 interviews for meaningful patterns

- Use a consistent interview guide, but remain flexible

- Record conversations (with permission) for later analysis

- Look for patterns, not just individual opinions

For keyword research:

- Analyze the top-ranking content for target keywords

- Look for question-based keywords and long-tail variations

- Track both search volume and keyword difficulty

- Don’t ignore low-volume keywords if they’re highly relevant

For competitive analysis:

- Identify 5-10 key competitors and industry leaders

- Analyze their top-performing content using SEO tools

- Study their content structure and publishing frequency

- Note their unique angles and positioning

For voice of customer research:

- Review the last 3-6 months of customer interactions

- Categories feedback by theme and frequency

- Pay attention to the exact language customers use

- Look for patterns across different touchpoints

- Identify gaps between what customers need and what you provide

Step 4: Analyze and Synthesize Your Findings

Raw data isn’t useful until you analyze it and draw conclusions. This is where many teams struggle; they gather great research but fail to turn it into actionable insights.

Create audience insights documents:

Synthesize your findings into clear, actionable insights. For each key audience segment, document:

- Their primary goals and challenges

- Questions they ask at each buyer journey stage

- Content preferences and consumption habits

- Decision criteria and evaluation process

- The language and terminology they use

Identify content opportunities:

Based on your research, create a prioritized list of content opportunities. For each opportunity, note:

- The topic and target keywords

- The audience segment it serves

- The buyer journey stage that it addresses

- The business impact (traffic potential, lead generation, sales enablement)

- The recommended format and approach

- Resource requirements

Step 5: Develop Your Content Strategy

This is where your B2B content research methodology directly impacts your content marketing services and execution.

Set clear goals aligned with business objectives:

Your content strategy should support specific business goals, like:

- Increasing organic traffic by X%

- Generating X qualified leads per month

- Improving conversion rates by X%

- Supporting sales with an X% reduction in sales cycle time

Create a content roadmap:

Develop a 3-6 month content roadmap that includes:

- Specific content pieces to create

- Target keywords and topics for each piece

- Content format and type

- Target audience segment

- Success metrics

Define your content pillars:

Identify 3-5 core topic areas where you’ll build depth and authority. These pillars should be:

- Highly relevant to your target audience

- Aligned with your product or service offerings

- Broad enough to support ongoing content creation

- Specific enough to differentiate you from competitors

Step 6: Test, Measure, and Iterate

The most successful B2B content marketing strategies involve continuous research, testing, and optimization.

Track key performance metrics:

For each piece of content, monitor:

- Traffic and engagement metrics (views, time on page, scroll depth)

- SEO performance (rankings, organic traffic, backlinks)

- Lead generation metrics (conversions, form submissions, downloads)

- Sales impact (pipeline influence, sales cycle velocity)

- Social engagement (shares, comments, mentions)

Gather ongoing feedback:

Continue collecting the voice of the customer data through:

- Content performance analysis

- User behaviour tracking

- Customer surveys and feedback

- Sales and support team insights

- Social media monitoring

Update your research regularly:

Plan to refresh your core research:

- Quarterly: Review content performance and keyword rankings

- Biannually: Conduct competitor analysis and content gap analysis

- Annually: Do in-depth customer interviews and comprehensive audience research

B2B Content Marketing Services: What to Expect from Agencies

If you’re considering working with a B2B content marketing agency, understanding their research capabilities is crucial. The best agencies don’t just create content; they base their content strategy on thorough research and analysis.

What Top B2B Content Marketing Agencies Offer

Leading agencies like Animalz, Blogs, Foundation, Optimist, and Siege Media differentiate themselves through their research-driven approach. Here’s what you should expect:

Comprehensive research phase:

Top agencies begin every engagement with research, not content creation. They invest time in:

- Understanding your business, products, and unique value proposition

- Analysing your current content and performance

- Researching your target audience through interviews and data analysis

- Studying your competitive landscape

- Identifying keyword opportunities and content gaps

According to industry data, agencies that prioritise research deliver significantly better results than those focused solely on content production volume.

Ongoing research and optimisation:

The best B2B content marketing services include continuous research. Agencies should:

- Monitor content performance and make data-driven adjustments

- Track evolving search trends and audience interests

- Conduct regular competitive analysis

- Gather ongoing voice of customer insights

- Test and optimise content approaches

Questions to Ask When Evaluating Agencies

When interviewing potential B2B content marketing agencies, ask about their research methodology:

- What research do you conduct before creating content?

- How do you gather audience insights?

- What tools and methods do you use for keyword research?

- How do you identify content gaps and opportunities?

- How do you incorporate the voice of the customer data?

- What metrics do you track to measure success?

- How often do you revisit and update research?

- Can you share examples of how research informed a client’s content strategy?

Agencies that can’t articulate their research process clearly likely rely more on assumptions than data, a red flag for serious B2B companies.

Real-World B2B Content Marketing Examples

Let’s look at how leading companies apply research-driven content strategies:

HubSpot: Educational Ecosystem Approach

HubSpot built its content empire on deep audience research. They identified that their target audience, marketers and sales professionals, needed practical education to improve their skills. This insight led to:

- Comprehensive blog covering thousands of marketing and sales topics

- HubSpot Academy is offering free courses and certifications

- Extensive template and tool libraries

- In-depth guides addressing specific challenges

The research-driven approach positioned HubSpot as the definitive resource, building trust and loyalty long before purchase considerations. This B2B content strategy example shows how understanding audience needs creates long-term brand value.

Mailchimp: Beyond Product Focus

Mailchimp expanded beyond email marketing content by researching its audience’s broader challenges. They discovered small business owners needed help with overall business growth, not just email. This led to:

- Resources addressing entrepreneurship challenges

- Content about branding, marketing strategy, and business operations

- Stories and insights from successful small businesses

- Educational content makes complex topics accessible

By addressing the full ecosystem of customer needs, Mailchimp embedded itself as an indispensable partner, not just a tool.

LinkedIn’s B2B Institute

LinkedIn recognised through research that B2B marketers valued data-backed insights about industry trends. Their B2B Institute now produces:

- Original research reports on marketing effectiveness

- Data-driven insights on B2B buyer behaviour

- Best practice frameworks backed by evidence

- Trend analysis and forward-looking perspectives

This positions LinkedIn as an essential resource for staying ahead of industry developments, demonstrating thought leadership through research.

Read More: UGC vs EGC: Difference, Examples & Best Strategy for Brands in 2025

Read More: Complete High-Intent Keyword Strategy Guide (2026 Update)

The Future of B2B Content Research

B2B content research methodology continues to evolve with technology and changing buyer behaviours. Here’s what’s shaping the future:

AI and Automation in Research

According to recent industry data, 94% of B2B marketers now use AI-powered applications. AI tools are transforming content research by:

- Analysing large datasets to identify trends and patterns

- Automating competitive content analysis

- Processing customer feedback at scale

- Generating topic ideas based on search data

- Predicting content performance before publication

However, AI is a tool for efficiency, not a replacement for strategic thinking. The most successful teams use AI to accelerate research but rely on human judgment for interpretation and strategy.

Real-Time Data and Continuous Research

Traditional research methods involved periodic, intensive research projects. The future is continuous, real-time research using:

- Social listening platforms monitor conversations constantly

- Analytics dashboards tracking performance in real-time

- Customer data platforms aggregating insights from multiple touchpoints

- Automated surveys and feedback collection

This shift from periodic to continuous research enables faster adaptation to changing audience needs and market conditions.

Personalisation at Scale

Research is moving beyond understanding broad audience segments to enabling individual-level personalisation. Advanced companies now research:

- Account-specific needs for ABM strategies

- Individual buyer preferences and behaviours

- Content consumption patterns by persona and journey stage

- Trigger events that indicate purchase readiness

This granular research enables highly personalised content experiences that increase relevance and conversion.

Make Research Your Competitive Advantage

A robust B2B content research methodology transforms your content from hopeful guesses into strategic assets that drive real business results. Research helps you understand what your audience truly needs, identify opportunities others miss, and create content that stands out in a crowded market.

The companies winning with B2B content marketing, whether they’re working with agencies or building in-house teams, share one trait: they invest in understanding their audience before creating a single piece of content.

Research isn’t glamorous, but it’s the difference between content that gets results and content that gets ignored. Make it your foundation, and everything you build on top of it will be stronger.